We all want people to feel good about engaging with experiences we create. We want those experiences to be positive, relevant, and helpful in ways that make our customers’ lives better, easier.

Regardless of where you work or whether you’re a researcher, designer, PM, or founder of the company, it’s likely that you regularly strive to achieve those all-important ‘aha!’ moments with your customers. And I think this is because, at a fundamental level, every single one of us wants to help people. We just have different tools and techniques for doing so

But good intentions are rarely enough on their own, and the reality is that customers are often frustrated, confused, or underserved by our product or services.

In order for our products to be truly helpful—to really make people’s lives better—we need to understand who we’re creating these experiences for and what problems they’re trying to solve. Otherwise, we run the risk of creating experiences that don’t meet the needs of our customers. And that wastes everyone's time—it wastes our time and our customers’ time. It takes away valuable hours and energy from people throughout the companies, from product to marketing to engineering to finance.

So what can we do about this? How can we make sure we’re creating the experiences our customers (and future customers) really need?

That’s where research comes in.

User research is systematic inquiry

As Erika Hall tells us in her seminal work, Just Enough Research, research is systematic inquiry. It’s a tool you use to learn more or increase your knowledge about a particular topic.

Research is the act of acquiring knowledge—we could literally conduct research on any topic under the sun. That endless potential scope is why it's so important that as practitioners, the research we are leading and conducting is focused and aimed at enabling decisions for our organizations.

I created a framework to help our team at User Interviews find and keep that focus.

NOTE: This framework was influenced by Reforge’s User Insights for Product Decisions, Kolb’s Experiential Learning Cycle, Emma Boulton’s Research Funnel, and Twig + Fish’s Ncredible Framework.

The Decision Driven Research Framework

The Decision Driven Research framework is a five-stage framework that is centered on the belief that the purpose of research is to enable decisions for your company, product, or service.

The phases of Decision Driven Research

- Decision Trigger: This is the first and most important phase, in which you identify that there's a decision that your team or organization has to make, or a question you want to answer.

- Scope Evidence: Once you know what decision needs to be made, take the time to review whether you have any existing data or evidence that you can use to inform your decision or answer your questions.

- Define Approach: If there's no existing data or you decide you need more in order to proceed, then you can determine the best approach or research method to inform your decision. (In other words, what method will get you the types of answers you need?)

- Exploration: Once you have a research plan , go out, explore, and gather additional insights.

- Reflect & Decide: Finally, analyze, synthesize, reflect on what you learned, and make informed decisions about what to do next.

In the rest of this article, we’ll take a deeper look at the first three stages of this framework. Together, these stages—Decision Trigger, Scope Evidence, and Define Approach—will help you create a clear and focused research plan that enables your team to make confident and data-driven decisions about [insert problem here].

Phase 1: Decision trigger

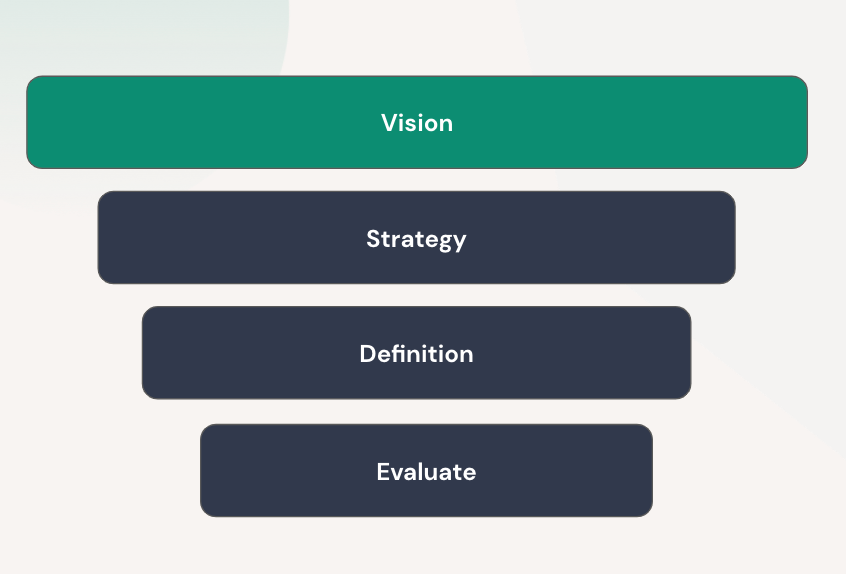

Within any organization or product team, there are four levels of decision-making, which act a bit like a funnel.

At the top of the funnel are those really big, broad decisions related to company or product vision (the “Big Picture”). As we go down the funnel we start getting more specific about the decisions we’re making related to our product or service.

The 4 levels of decision-making

Vision

The first type of decision that companies have to make are typically vision decisions. These are the big picture calls that are focused on informing the long term direction of a company, product, service, or even market opportunity. Typically, when we make these types of decisions, the questions we ask are pretty open ended. We try to gather data that helps us get clarity on big picture beliefs, philosophies or opportunities that might impact our customers lives or wider marketplace

Strategy

The second type of decision that teams make are strategic. With strategic decisions, you often know the problem you're solving for and you're ready to define the strategy or approach that you’ll use in order to solve this problem. When we make these types of decisions, we’re looking to get clarity on customers behaviors, expectations, frustrations to help us determine our plan of action. The questions we ask can be open ended.

Definition

With definition decisions, you’re trying to determine how potential ideas and solutions may impact your audience or customers. At this point, the questions you’ll ask will start to get more focused. You’ll be seeking to understand how a customer might behave or interact with a potential solution in specific contexts.

Evaluation

Finally, we have evaluation decisions. At this point, the questions you ask will relate to how people are using your existing product or service, especially any pain points or challenges they might be encountering.

Whenever I kick off a research project, I take a moment to reflect on the following questions:

- What types of decisions need to be made related to this work?

- What company or product goals does work support?

Since our research team at User Interviews is small and resources are precious, this self reflection ensures our team is working on projects that will have impact on company-wide decisions rather than conducting research for the sake of research.

Phase 2: Scope evidence

Our own companies are FULL of information.There’s no shortage of data out there—it just might not live with your research team (yet).

Some of the places my own team commonly turns to for data:

- Analytics dashboards like Google and Mode

- Quantifying bugs or customer feedback that are coming through support tickets or conversations that are taking place with customers

- Published research from other teams, market studies, books, Google searches

One of the richest mines of customer information (and one that I see frequently overlooked by researchers and designers) is your own team. Folks from customer success, operations and support are on the front lines talking with customers every single day—they may already be sitting on the qualitative feedback you need to make your decisions.

Brainstorming & bias-checking

To get others involved in our scoping process is at User Interviews, we typically hold a kickoff brainstorm session where we start to tease apart: facts, opinions & guesses. These sessions get people from other parts of the company involved, which helps us avoid bias and identify what it is we already know. It allows stakeholders to feel heard and make sure we're focusing on work that is actually important to the organization.

Phase 3: Define approach

This is the point when I start to take all of the information I learned and begin putting together a high-level plan for research.

I generally include information about the type of decision that needs to be made, the goals of the research (what we hope to learn), and even how I think the project will go.

I also choose the research method(s) that I’ll use in the next phase.

Here’s a chart that we use internally at User Interviews to select the right research methods for the types of decisions we want to make.

.png)

Do more impactful, focused UX research

There are many benefits to adopting the Decision Driven Research framework (or a variation of it that works with your own processes).

For one thing, it enables easier prioritization of research projects to make sure you're spending your time on projects that align with a company decision or goal. This framework also enables you to take advantage of existing data inside your company to save yourself from doing unnecessary or redundant work. Finally, you're able to bring it back to research basics and select your research method based on what you hope to learn—an approach that makes it far, far more likely that the work you’re doing will be successfully used to enable decisions. (Skeptical stakeholders? What are those?)

In a later article, I’ll dive deeper into the exploration and reflection stages of this model!

In the meantime, some resources:

.jpg)

.jpg)

.png)